You are probably more familiar with the 1099-K’s distant cousin, the W-2 — that pesky form that comes to employees every year listing out their wages and what taxes were withheld from their paychecks. The 1099-K is a similar form but works for different income streams.

The 1099-K originates in business transactions performed using online payment systems like PayPal. The situation changed for everyone starting January 2022, eliminating a potential tax loophole for small businesses and creating substantial more risk for personal use.

The risk to the general public arises in that many use these platforms for personal transactions as well (e.g., sending money to Aunt Jane for her birthday). Unless these customers are careful about properly classifying their payments as personal, the recipient can easily wind up with unexpected and improperly recorded ‘business income‘ when the tax man comes next year.

Where’s the Problem?

The 1099-K is the form used by payment companies to report the business transactions they saw occur on their platform throughout the year to the government. The government then has a record of potential income and will expect the individuals receiving that money to pay taxes accordingly.

But in the case of sites like PayPal and Venmo where personal transactions also occur, the companies rely on the sender to tell them whether they are sending money to a seller or to family & friends. If the sender does not properly mark the type of payment they have sent, the receiver might find themselves mislabeled as a seller.

At the end of the year when the site reports business income to the government on the 1099-K, the receiver can suddenly find the IRS asking pointed questions about why they are not reporting that money they received as income per their expectations. This substantially increases the likelihood of a rejected return or an audit.

Say, for example, that you use Venmo to send money to your sister Megan as your share of the pizza bill. If you did not correctly classify this on the Venmo App as a “personal” transaction, Megan might find herself ordered to report this as business income on her taxes.

One group vulnerable to this risk in 2020 and 2021 were expats. In the wake of the COVID-19 lockdowns, expatriates across the globe found themselves incapable of accessing their foreign bank accounts. They needed online, international banking systems that would exchange the money and send it abroad with a minimum fee and rapid delivery. Many turned to sites like PayPal, shifting money from one country to another in order to reach a bank they could access. The ultimate effect was that they were sending money from themselves to themselves.

Still others continued using these sites to send money home to spouses, parents, family, and friends who they were supporting. Given the amount of money expatriates shift in and out through these platforms, they could easily find themselves or their families meeting the thresholds for required 1099-K reporting.

Who Sends and Who Receives the 1099-K?

The 1099-K is sent by third-party payment processing companies (e.g., PayPal) to online sellers who use their services to receive customer payments. This will include any seller who is receiving payment from a buyer in return for the sale of goods or services.

There are many different payment processing services, some of the most common can be found on this list from X-Cart.com. Easily recognizable options include Venmo, PayPal, Square, Bitcoin, Amazon Pay, 2Checkout, CashApp, Zelle, Google Pay, Apple Pay, and Stripe.

Also note that if you use multiple payment services (e.g., both Stripe and PayPal), you will have a separate 1099-K from each organization.

This is especially an issue for online artists and creators who sell across multiple platforms which in turn use different payment service systems. For example, Medium sends out payments with Stripe while RedBubble uses PayPal. An individual may thus have a 1099-K from both Stripe and PayPal if they worked with both firms throughout the year.

The 1099-K only deals with the income processed by these third-party, online platforms. Alternative forms of payment (e.g., cash or check) would generate a different form or reporting method. Be careful to report ALL of your taxable income and speak with a tax professional if you are not sure what that entails.

How It Works

The payment processing organization is legally required by the IRS to track the transactions you complete using their platform. Generally, if you are receiving money, it will be earmarked by the sender as either money for friends and family or payment for goods or services.

In the first case, the company recognizes there is no ‘business income’ and moves on. Depending on how large that gift to friends / family was, you may need to self-report and deduct it from your taxes. But that is a different issue and not covered in this article.

In the second case, the company marks it as ‘business income’ and starts to monitor your account as a potential 1099-K recipient. When these business transactions reach a certain limit set by the IRS, the organization is required to fill out a 1099-K and send a copy to both you and to the IRS. Be careful, if yours gets lost in the mail, you may have to go to their website to find and download the form. Again, expats or people who moved in the year where their mail is mixed up may easily find these forms slipping through the cracks.

Once you receive the 1099-K, you are then required to carefully ensure that the income is properly reported on your taxes and that you pay any business taxes as required. If you don’t. . . remember the IRS already got a copy of that form as well, so they will come looking for their money.

Is this a New Tax?

It is important to note that the government here is not actually changing how taxes are calculated. Businesses were already required to report their income (including self-employment income) over certain thresholds, and this new update does not change what transactions are meant to be taxed.

The IRS is responsible for tracking and properly taxing billions of dollars passing through American accounts each year. Generally, they prefer a system of checks and balances to ensure that no one is being taxed too much or that people are not attempting to fraud the system.

With a W-2, 1099-MISC, 1099-NEC, such a system is already in place. Two people report on income – the payer and the recipient. With a W-2, the employer starts by filing the form with both the employee and the IRS. The employee checks their W-2 and then submits their income on their individual taxes (the 1040). If the employee believes the W-2 was incorrect, they should have followed the proper procedures to have the employer submit a corrected W-2 or to correct it on the 1040 itself. The IRS can then compare what they’ve heard from the employer with what they’ve heard from the employee and ensure the two amounts match.

With payments online from one individual to another, the IRS has a harder time ensuring that income is properly and accurately being reported. Without the employer there to corroborate, the IRS is looking for someone to verify the income being reported to them by online businesses. In the past, they used the company who processed the exchange of money.

The payment processor (e.g., PayPal) files the 1099-K with both the IRS and the recipient. The recipient then reports their actual income on their 1040. If that amount does not incorporate the money identified on the 1099-K, the IRS will begin the process of investigating the discrepancy. This could quite potentially lead to an audit which can be both time and financially consuming.

In the past, the 1099-K was not filed unless the taxpayer received enough income and completed enough transactions to reach a rather high threshold. It was high enough in fact that few taxpayers reached the threshold without being involved in substantial business. Aunt Jane who gets birthday money or expats receiving funds from family abroad would not easily find themselves receiving enough money or completing enough transactions to trigger a 1099-K. As a result, many personal users for sites like PayPal failed to develop a habit of properly classifying their payments as family and friends when applicable.

What the IRS is doing now is lowering that threshold so that the 1099-K is reported over much lower income generation.

The Threshold

Up through 2021, organizations were obligated to submit the 1099-K if the account owner met BOTH of the following qualifications:

- They received MORE than $20,000 throughout the year (aggregate/total)

- AND participated in more than 200 transactions.

Clearly, few people who used these platforms to send gifts or exchange money with family and friends would be likely to hit the above threshold within a year. Even those who did send a large amount of money for one reason or another rarely tipped over the 200 transaction minimum.

As of January 2022, this changed. Now companies will report the 1099-K if the owner receives $600 or more and there is no minimum transaction threshold. If that scares you into double checking your payment accounts, good. Users in the future will have to be a lot more careful NOT to go over the limits or to at least carefully classify your transactions properly.

The new limit is total transactions of $600 or more. There is no minimum transaction threshold

“Understanding Your 1099-K” – IRS

What If I Already Have a Problem

If you find that you already ran afoul of the 1099-K rules through improper classification, contact both the processing company and a tax professional to address your issue. Work with them to see if there are ways to correct the issue without it leading to a 1099-K or how to address the issue with the IRS as needed.

How to Find Your 1099-K?

The 1099-K must be sent out to all recipients before January 31 of the following year. This means a lot of taxpayers have either already received them (in the mail, by email, or from the website according to your settings) or they will very shortly.

If you are interested in double checking your 1099-K, go to the payment services website and look for the place where they publish “Tax Statements.”

Example 1: Stripe

You can find your 1099-K on your Stripe Dashboard with the following link: https://dashboard.stripe.com/settings/documents

Example 2: PayPal:

- Go to “Activity” on the toolbar along the top.

- Go to “See More Reports”

- Select “Tax Documents.” From here you can probably find the 1099-K from 2020 and see what it looks like.

In addition to the Form 1099-K, you’ll also have access to an Excel spreadsheet that lists the date, who the money came from, who received the money, and the amounts.

Remember to Classify Your Payments

Many of those payment platforms designed to allow personal transactions provide a way for the payer to identify which category a payment belongs to: Business or Friends & Family.

Example 1: PayPal

For PayPal, start through the usual process of selecting to Send money, choose the recipient, the amount, and select a payment method. You’ll then arrive at a summary page asking you to review the payment.

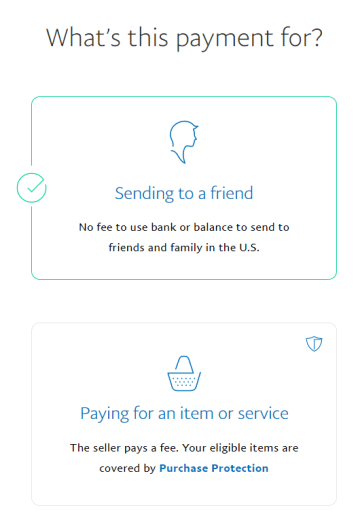

You’ll notice that right below the amount is a default type of transaction. In the example below, that default is Sending to a Friend. However, that may not be the default on your account. To change the type of transaction, select Change to pull up the options.

You’ll be given two choices:

- Sending to a Friend

- Paying for an Item or Service

If this payment is intended as part of a business transaction, then you should properly select “Paying for an Item or Service.” But if your payment is simply sending money to friends, family, or yourself, be careful to classify the transaction properly.

Other payment systems will often have similar strategies for classification. If you cannot find a way to classify your transaction appropriately, contact the platform and verify the situation before proceeding. If you are the recipient of funds, read the details and ensure that the sender classified the transaction properly.

At all times, be honest and precise in completing the transaction, ensuring that both yourself and the recipient are operating according to the rules. If you have questions about the new IRS rules and how to remain in compliance, speak with a tax professional and/or the IRS directly. Every individual’s situation may be different, and you alone are liable for issues that arise from improperly completing online payments.

DISCLAIMER:

The information offered through our Services is general information only and may not apply to every individual. We make no warranties or promises regarding the accuracy, validity, reliability, availability, or completeness of the data herein. This information is not intended for reliance. Under no circumstances will Blessing Associates, LLC or its owners & operators be liable for any problems that may result from using or reading this information. Individuals with a particular issue are recommended to contact attorney’s privately for tailored solutions.

The use of the Internet or phone as means of contacting this firm or any individual attorney of this

firm will not establish an attorney‐client relationship, thus do not use this form to submit confidential or time‐sensitive information. Whether you are a new or existing client of the firm, Blessing Associates, LLC cannot represent you on any new matter until the firm has made a determination that there is no conflict of interest and that it is willing and otherwise able to accept the new engagement. Unless

and until Blessing Associates, LLC has informed you it is willing and able to accept your new matter, do not send the firm any information or documents that you consider private or confidential. No attorney-client relationship is created without the formal signature of a contract and prior agreement by both parties. Continued use of our Services serves as evidence that you approve our Privacy Policies and Terms & Conditions.